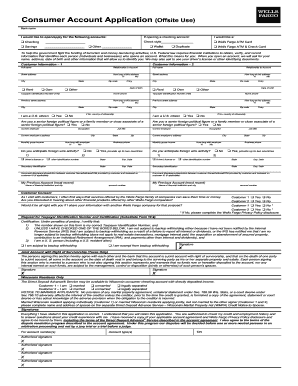

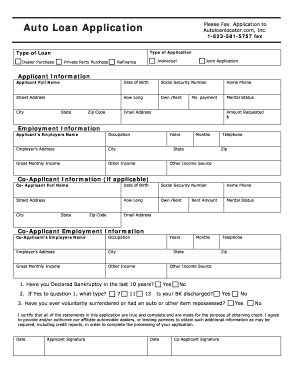

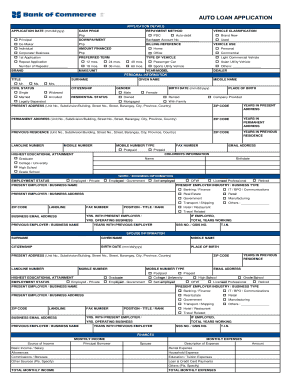

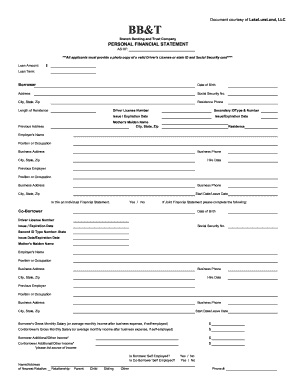

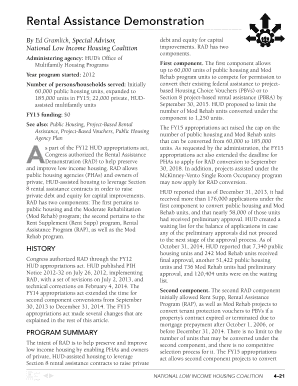

Get the free sample loan application from a car dealership financial institution form

Get, Create, Make and Sign

Editing sample loan application from a car dealership financial institution online

How to fill out sample loan application from

Point by point guide on how to fill out a sample loan application form:

Who needs a sample loan application form?

Video instructions and help with filling out and completing sample loan application from a car dealership financial institution

Instructions and Help about car loan application example form

If you#39’re after a new car but don'tnecessarily have the funds to cover you#39’re going to need to secure some sort of car finance step one work out what you can afford only borrow what you need if you can afford to pay for the majority of the car yourself and are happy to put down a large deposit then do so don't take out a loan covering thefull cost of the car just because toucan because it will cost you in the long run think about over how long you want to repay the loan and how much you'rehappy to pay each month if you#39’re afterglow month of your payments you may repay it off over a longer period we'll have more to pay in the final month think about how long you plan to have the car before signing yourself up to along agreement and look at the typical APR that's annual percentage rate chichis the cost of the credit charged over the period of the loan step 2 consider the options there are three mains forms of finance available to you conditional sale commonly known as HP personal contract purchase or personal lease conditional sale with conditional sale you pay a deposit up front for the car the balance plus interest and charges are repaid in equal amounts each month until you paid for the whole thing once the final payment is made the car belongs to you this is a great way of getting your hands on a new car without the need to part with the whole cost upfront personal contract purchase personal contract purchase is similar to higher purchase in that you pay deposit usually around 10% plus an agreed number of fixed monthlies payments the main difference is that the lender predicts what the car will be worth at the end of your agreement, and you only repay the capital difference between the two with interest this means as your only financing a proportion of your car that your monthly payments tend to blower at the end of your agreement you have three options you can part exchange your car for the new one you can pay the amount the lender predicted your knowledge worth at the end of the agreement a down the car outright, or you can return the car to the dealer with nothing further to pay subject to mileage and vehicle condition the benefits of this scheme are that you get to keep your monthly payments lowland have the opportunity to get a shiny new car every two or three years personal lease with a personal lease you never actually own the car you rent itlong-term until the end of the agreement and then simply return it to the dealer swapping it for a brand spanking new one personal lease is great if you don'twant to worry about unforeseen costs the car losing value over time or selling the charity#39’s hassle-free

Fill car application form pdf : Try Risk Free

People Also Ask about sample loan application from a car dealership financial institution

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your sample loan application from online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.